Gen-Z’s Financial Guide to the Big Not-So-Beautiful Bill

*Financial recommendations are based on personal experience and opinion.

On the 250th anniversary of the United States, President Trump signed into law the One Big Beautiful Bill Act, an 1,100-page piece of legislation whose effects will be felt for decades to come. The bill is characterized by aggressive cuts to essential programs that millions of Americans rely on—slashing $600 billion from Medicaid, cutting $230 billion from SNAP (colloquially known as food stamps) and imposing strict work requirements that could leave 11 million people without health coverage over the next decade.

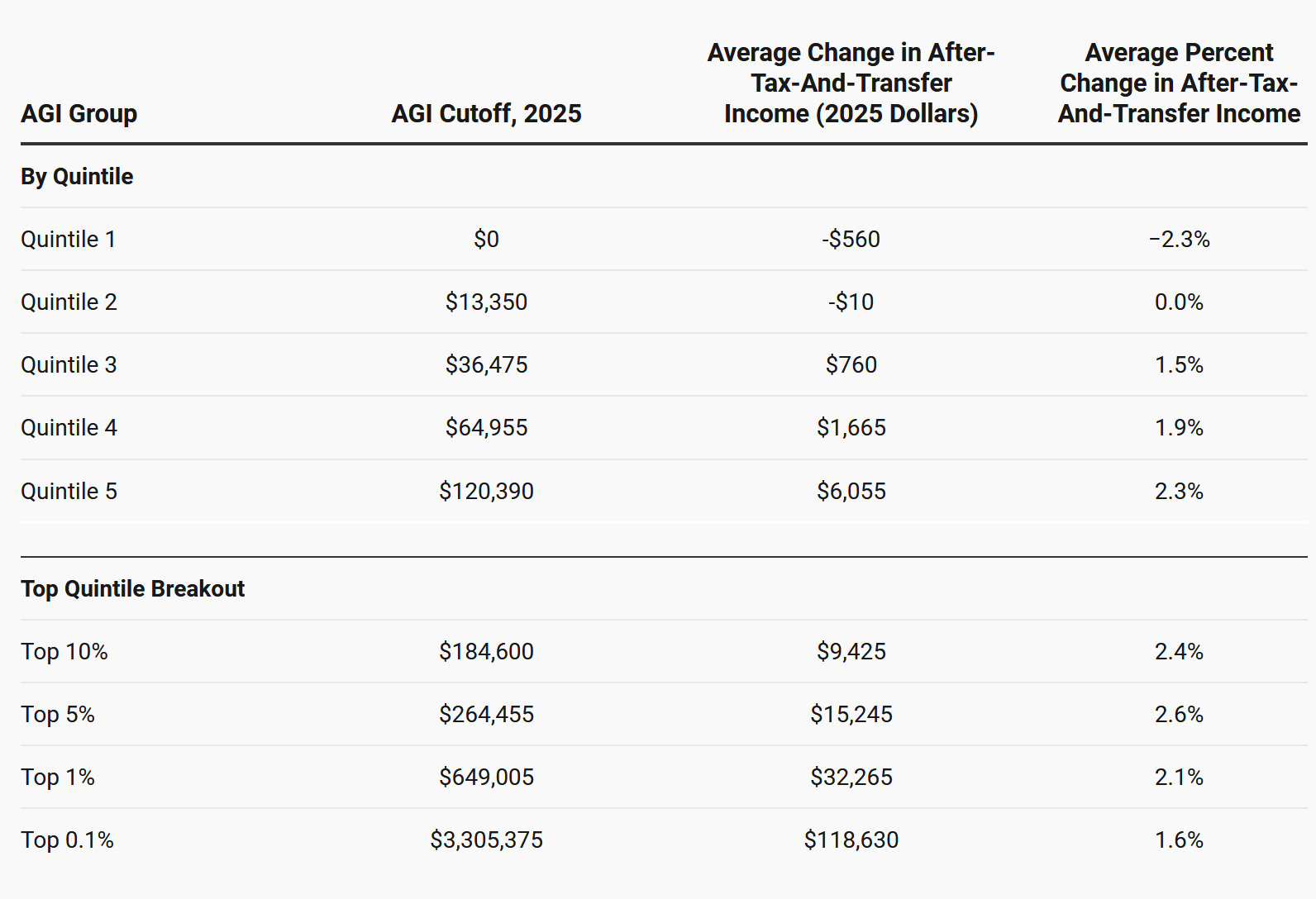

The bill also introduces and extends $4.5 trillion in income tax cuts, the largest amount in American history. The financial relief promised, however, goes disproportionately to the wealthy.

(Credit: Yale Budget Review: Average change in income from 2026-2034 for Americans, separated by quintiles of income. Net change in income calculated after reductions to food stamps and Medicaid)

In fact, more than two-thirds of the tax cuts are going to households with incomes of $217,000 or more. As Generation Z enters a workforce where starting salaries are nowhere near that threshold, most of us will see little—if any—benefit from these historic tax breaks. Instead, we’re left to navigate a landscape where the safety nets our parents relied on are being pulled out from under us.

How the Bill hits Gen Z — Debt and Education

But the impact doesn’t stop at our paychecks. For Gen Z, the Big Beautiful Bill lands hardest on the path to higher education and the debt that comes with it.

Student Loans Get Harder to Manage:

The bill ended some of the most helpful income-driven repayment plans, like the SAVE plan, which allowed borrowers to cap monthly student loan payments based on their income. It also eliminates the Grad PLUS loan program, which many students use to pay for graduate school, and caps Parent PLUS loans at $65,000 per student. If you’re planning on grad school or relying on your parents to help with tuition, your options just got a lot more limited. For many, the only option present is to take out loans from private firms – who are free to set interest rates as high as the market will bear.

Pell Grants and Financial Aid Shrink:

The bill ends Pell Grants for higher-income families and shortens the open enrollment period for ACA health plans, which can affect students and recent grads who rely on these programs for affordable education and health coverage. If you’re a student from a middle-class family, you might find yourself squeezed out of aid you were counting on.

Food and Housing Insecurity Rises:

With SNAP eligibility tightening and Medicaid cuts, students who rely on food assistance or health coverage are at greater risk. Already 2.2 million college students are experiencing food insecurity but do not qualify for food stamps. For students who are juggling classes, a part-time job, and trying to make rent, losing access to these programs could mean making impossible choices between food, healthcare, and tuition.

The immediate impacts of the bill are clear, the bigger question is: who stands to benefit from these changes?

Who wins and why

While the Big Beautiful Bill is sold as relief for working Americans, the real winners are those whose wealth comes from stocks and business ownership, not paychecks. Corporate America celebrated the bill's passage, with the US Chamber of Commerce and Business Roundtable—two of the most powerful lobbying groups in Washington D.C.—applauding the extension of corporate tax breaks.

The legislation didn't touch the stock buyback tax or the corporate alternative minimum tax, allowing companies to keep funneling profits into share repurchases that boost their stock prices. When corporations buy back their own stock, executives with stock-based compensation get richer, and the wealthy (richest 10%) —who own 93% of all stocks—see their portfolios balloon.

The bill also restored a massive tax break that lets businesses immediately write off equipment and research costs — a provision that could save tech giants like Meta $15.1 billion over three years.

In a CNBC CFO Council survey, numerous Chief Financial Officers were confident the bill would pass, with the knowledge that the game was rigged in their favor. Years of lobbying, campaign contributions, and revolving doors between Congress and K Street ensured that when it came time to write the "big, beautiful" legislation, the wishes of corporations and wealthy Americans came first.

This is the pattern we've seen for decades: tax cuts are marketed as much-needed relief for the middle class, but the vast majority of benefits flow upward. The 2017 Tax Cuts and Jobs Act promised wage increases and job creation, but corporations used their windfall for record-breaking stock buybacks instead. Now, the Big Beautiful Bill makes those cuts permanent while adding new goodies for the already-wealthy.

The cruel irony? While the bill increases the national deficit by $3.4 trillion, politicians will soon claim we can't afford programs that actually help working people. They'll point to the deficit they created as justification for more cuts to education, healthcare, climate initiatives, and whatever else not deemed essential by their corporate backers—the very programs Gen Z depends on.

Why It Matters

Gen Z is already struggling financially. Nearly half of Gen Z runs out of money each month, and less than a quarter consider themselves financially stable. The generation has the lowest financial literacy scores of any generation at just 38%, while simultaneously being targeted by predatory financial products.

Forty-four percent of Gen Zers used buy-now-pay-later (BNPL) services last year. That's about 30 million young people stretching purchases across multiple paychecks. Meanwhile, 24% of BNPL users have made late payments, up from 18% in 2023.

This financial vulnerability isn't accidental. In our economy, the point of value—money—isn't going to the people creating it, but to the very corporations that this Big Beautiful Bill benefits. These corporations have historically shown that most of their profits go into stock buybacks and further growth—making their products more appealing and addictive for consumers, rather than improving worker conditions or lowering prices.

The culture we're already in, where consumption is marketed as an antidote to economic anxiety, adds to the financial impact of the BBB. When you're stressed about money, the system profits from selling you temporary relief through spending—creating a cycle that keeps you financially vulnerable.

How to Keep Going

The reality is stark, but it's not hopeless. Here are a few ways to build financial resilience in a system designed to extract wealth from young people:

Increase Financial Literacy

The bare minimum goal should be beating market inflation. This means putting your money into things that grow faster than prices rise. Even small amounts invested in diversified ETFs can establish significant wealth over the long term through compound growth. High-yield savings accounts, Roth IRAs, and maxing out 401(k) contributions (especially if your employer matches) are all ways to ensure your finances stay ahead of inflation.

Practice Conscious Consumption

This is the most important point: buying things has never been more convenient, and there's been a rise of consumerism, notably marketed to Gen Z as therapy for our current economic reality. However, this system relies on your financial apathy and your willingness to participate in your own exploitation.

Every purchase is a vote for the kind of economy you want to live in. When you buy from companies that lobby for bills like this one—companies that profit from your financial stress while supporting policies that make you more financially stressed—you're funding the system that's working against you.

Before making purchases, especially large ones or those using credit/BNPL services, ask yourself: Is this a need or a want? Am I buying this because I need it, or because I'm trying to feel better about a system that's designed to make me feel bad?

It's important to remember that Gen Z didn't create these financial challenges. We're inheriting a reality shaped by people decades older than us, backed by corporations that serve their interests, not ours. The barriers we face—from housing costs to student debt to an unstable job market—are higher than previous generations dealt with. Our position is fundamentally unfair, but we still have to make it through. The only real way to do that is by building genuine community and looking out for each other. In a system designed to isolate and extract from us, our solidarity becomes our strength.

The Big Beautiful Bill isn't just policy – it's a wealth transfer from young, working Americans to corporations and the already-wealthy. Understanding this isn't about becoming cynical; it's about becoming strategic. Your financial decisions, multiplied across millions of Gen-Zers, have the power to reshape the economy that's currently reshaping you.

The system counts on your participation. Make sure you're participating on your own terms.